CONSOLIDATED SALES GST REPORT

Key Features

Consolidated reports are an essential part of the accounting process for all the companies.

This key information provides perspective on the entire business and they remain as an essential part of the process.

The ultimate advantage of consolidated reports should be ease of understanding and analysis of a company’s financial condition for investors, creditors, vendors and anyone else who needs to know how secure the company is.

Consolidated Reports are essentially aggregated financial results.

The Major reasons of using the Consolidated Reports for the companys are Performance, Strategy and Efficiency.

Companies can often use the word consolidated loosely in financial statement reporting to refer to the aggregated reporting of their entire business collectively.

With this Module, all the GST Taxes will be split into CSGT, SGST, IGST and CESS Taxes in Invoice Forms and Reports as per the Indian Standard.

Consolidated Reports present the Financial position and results of the operations for a company and are generally consisdered to be more useful than any other separate reports.

Consolidated Reports are presented for the benefit of Shareholders, Creditors, Customers and other resource providers of company.

Consolidated Reports allow investors, financial analysts, business owners to get a complete overview of the company and they can also view the overall health of the business. And also there is less paperwork involved.

Consolidated Reports cuts out all other report transactions that occurs in the company. Eliminating these transactions gives a simplified view of business performance.

Consolidated reports will continue to evolve to make the process of the company even more transparent.

These reports are more reliable and easier to use. Consolidated Reports has made easier and can be used on regular work to improve the process of the company.

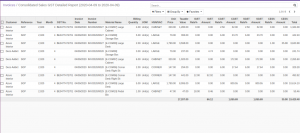

As per the Indian Standard, all the taxes will be split up into CGST Rate, CGST Amount, SGST Rate, SGST Amount, IGST Rate, IGST Amount, CESS Rate and CESS Amount in Invoice Form and Reports.

The Workflow

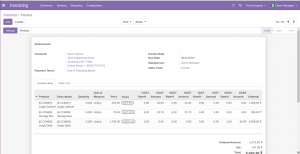

Step 1 : In Invoice Form the Taxes are splitted into CGST Rate, CGST Amount, SGST Rate, SGST Amount, IGST Rate, IGST Amount, CESS Rate and CESS Amount in order to get the Values of the same in the Report.

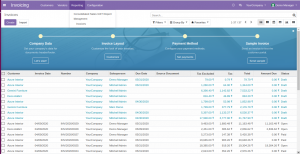

Step 2 : Please find the Report Menu in the mentioned path. In Invoicing Menu, Under Reporting tab -> Consolidated Sales GST Report.

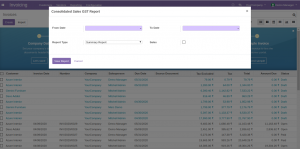

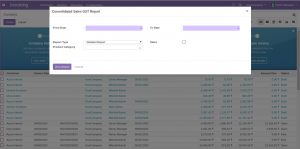

Step 3 : In Consolidated Sales GST Report Menu, you will have the Date Ranges such as From Date and To Date, Report type and Sales Boolean.

Step 4 : Report type field will have two types, one is the Summary Report and the other is Detailed Report. If the Report type is detailed, then Product Category field will be displayed.

Step 5 : Sales Boolean should be selected for generating the report, else the below mentioned warning will be popped up for the same.

Step 6 : Kindly fill in the Date Ranges and select the Report type as Summary Report and Sales boolean to get the Consolidated Sales GST Summary Report.

Step 7 : Invoices that are in Open and Paid state only will be displayed in Reports. Please find the Consolidated Sales GST Summary Report in the below screenshot.

CONSOLIDATED SALES GST REPORT

Consolidated Sales GST Report Module helps you to capture the Customer's Sales Invoice Values, GST Tax Values and all other Invoice details based on specific Date Ranges and remains as essential part of the business process for a company.

Category:Odoo 12